private reit tax advantages

Therefore the dividend yield to. The strategy is for the developer and their investors to sell their investment real estate in a tax-deferred transaction in exchange for operating partnership OP units convertible on a one-to-one basis into shares in the REIT.

Private Equity Vs Public Equity Raising Real Estate Capital

Leverage-private REITs are typically low leveraged because they traditionally borrow from banks.

. Tax benefits of REITs. Broadly speaking a company is first taxed at the corporate level and when that income is distributed to. Note however that the conversion of an OP unit.

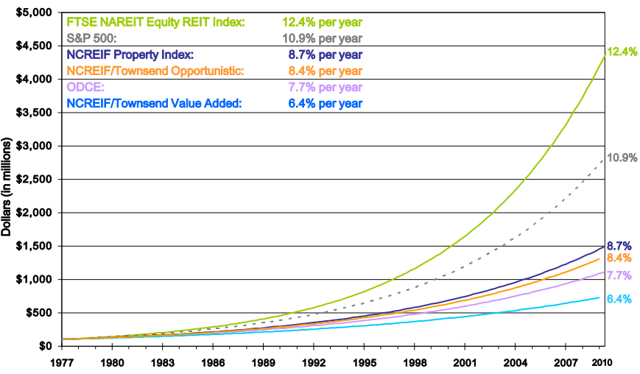

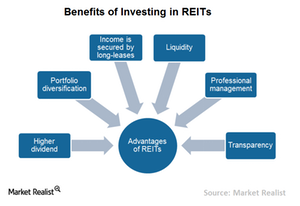

Private REITs can potentially offer target total returns ranging from 10-13 and cash yields from Most private REIT investments are relatively well diversified depending on their portfolio size and aim to provide reliable distributions. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. Thus in general a REIT owes no federal income tax if its dividends paid are at least equal to its taxable income.

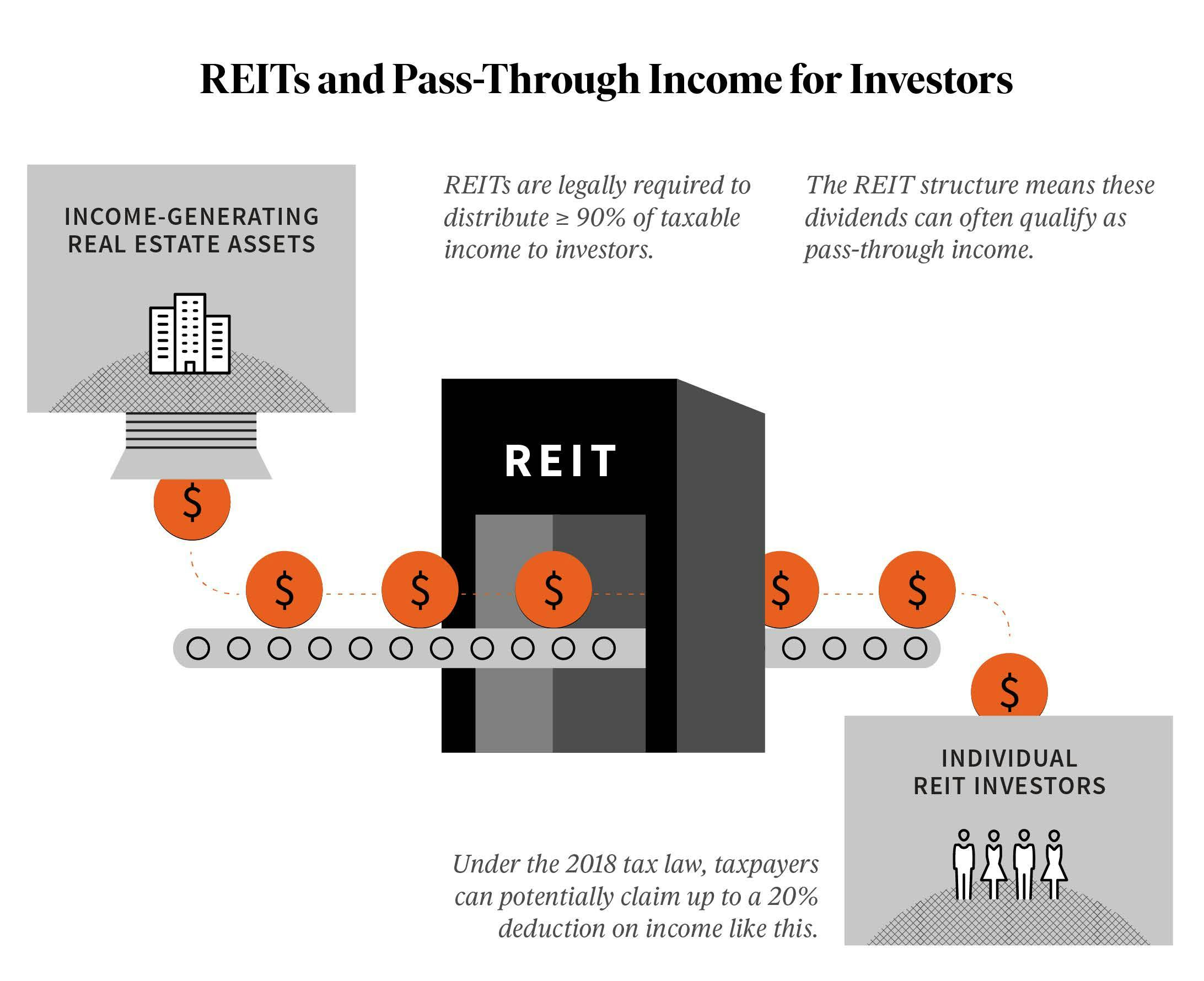

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. A benefit of investing in a fund with exposure to multiple properties is built-in. The pass-through deduction allows REIT investors to deduct up to 20 of the dividends paid from the REIT.

One of the many government tax. Earlier this month Griffin-American Healthcare REIT III also entered agreements to acquire Premier Medical Office Building a 45000-square-foot medical office building in Novi Michigan for. Origins IncomePlus Fund generated a trailing 12-month total return of 212 in 2021.

Understanding the Tax Benefits of REITs. REITs are partial conduits because unlike corporations in general REITs may deduct dividends paid in determining taxable income. Located in Clifton New Jersey ARCTRUST is a private real estate investment trust REIT sponsored by ARCTRUST Properties that focuses on the development acquisition and financing of net lease properties.

Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. REIT investors can deduct up to 20 of ordinary dividends before income tax is assessed. REITs as a Blocker of Unrelated Business Taxable Income UBTI and.

Wachovia Hybrid and Preferred Securities WHPPSM Indicies. Here are the top tax benefits investors earn when investing in REITs. Ad Origins IncomePlus Fund generates stable monthly distributions appreciation potential.

This means REIT investors only pay. Private Equity Real Estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through depreciation. A REITs shareholders are taxed on.

With Decades Of Experience Let Cornerstone Help With Tax Advantaged Investments Today. REIT for federal income tax purposes pursuant to section 856 of the Internal Revenue Code for the. Another advantage of REITs is that they must annually distribute almost all of their rental and capital income as dividends to shareholders which results in some favorable tax benefits.

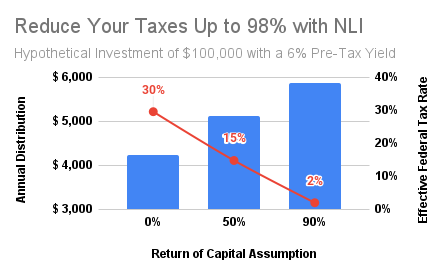

REITs function like a blocker corporation in a real estate investment fund so setting up the REIT as the investment entity reduces the number of entities needed in the structure. After-tax yield is reflective of the current tax year which does not take into account other taxes that may be owed on an investment in a REIT when the investor redeems his or her shares. Search Reit jobs in Weehawken NJ with company ratings salaries.

Under the Tax Act the use of REITs has the ability to provide significant tax benefits for not only tax-exempt and foreign investors but now also US. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. The primary tax benefit of a REIT is the avoidance of what is called double taxation that is the payment of corporate tax and personal tax on the same income.

CORPORATE PROPERTY INVESTORS. Tax Advantages- private REITs have positive tax advantages. TAX COURT OF NEW JERSEY DOCKET NO.

Preferred shares in addition to five. Ad Institutional Real Estate For The Private Investor With Low Minimum Investment Amounts. Ad Bold Trades on Real Estate - In Either Direction Bull or Bear.

Rowe Price Has a Range of Solutions. Upon redemption the investor may be subject to higher capital gains taxes as a result of a lower cost. 211 open jobs for Reit in Weehawken.

For starters REITs must disburse a minimum of ninety percent of their taxable income to investors. 6 REIT Tax Advantages. REITs are an excellent way for people to build their passive income.

The list below summarizes a few of the main advantages of starting a private REIT. The privately held companys geographic. Individual REIT shareholders can deduct 20 of the taxable REIT dividend income they receive but not for dividends that qualify for the capital.

Because they arent as heavily regulated private equity firms can be nimble and flexible in their. Ad The Power of Over 85 Years of Investing Experience On your Side. Investors experience tax savings advantages from depreciation and long-term capital gains.

The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. Returns are a critical part of most REIT Advantages and Disadvantages. APPROVAL OF THE TAX COURT COMMITTEE ON OPINIONS.

Reit Vs Real Estate Syndications Goodegg Investments

The Case For Private Real Estate White Coat Investor

Reits Vs Private Real Estate Seeking Alpha

Tax Advantages Of Reits Breit Blackstone Real Estate Income Trust

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

Reit Tax Benefits Questioned As Influence Over Nursing Homes Rises

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Reits 101 A Beginner S Guide To Real Estate Investment Trusts Fundrise

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

A Complete Guide To Reit Taxes The Ascent By Motley Fool

What Are The Potential Tax Benefits Of Private Real Estate Investing Noyack Logistics

Tax Advantages Of Reits Breit Blackstone Real Estate Income Trust

Advantages And Disadvantages Of Investing In Reits

Reit Investing What Is A Reit Ally

Private Reits In A Volatile Market

Reit Investing And Dividends Explained Money Morning

Reits Vs Private Equity Real Estate What S The Difference Caliber

What S The Difference Between Reits Real Estate Private Equity And Multifamily Syndication Invest On Main Street